This article is more than ten years old. It originally ran on a now-defunct website called The Gloss, where Bullish got its start. This post was created entirely by humans, as AI didn’t exist back then (but also: why would you want to read something no one could be bothered to write?) For more recent posts, try here.

I grew up reading Readers Digest. From ages 9-16, I read every single word of every single issue: This is Joe’s Pancreas. How to Protect Your Retirement Savings from Liberals. Drama in Real Life.

Every month, Drama in Real Life told the true story of someone who had fallen while mountain climbing and survived for days on a ledge the size of a lunch tray; or been mauled by a bear; or had a premature baby that slowly died and then looked down on its bereaved family from heaven; or been trapped in a burning building and recovered for months in a burn unit, receiving painful ass-to-face skin grafts, all played out over twenty-plus pages.

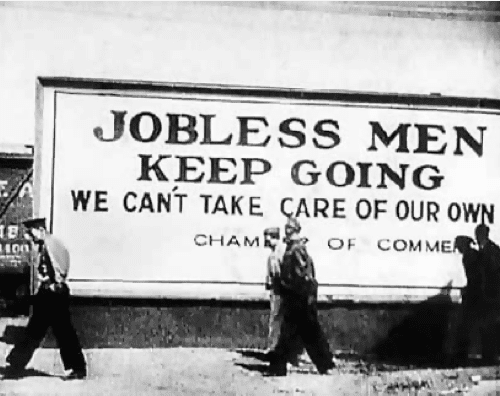

So, I grew up just assuming that adulthood entailed catastrophic events, and that no mater how hard you work in life, your family will always become trapped in a burning car.

Every erstwhile boyfriend of mine for the past 5-10 years could easily recount my plans of how I intend to make a living at such point that I am paralyzed so severely that I can only move my eyes (they have computers that you can operate using eyeball movements; I use such a computer to write test-prep manuals while maintaining an extremely witty blog). There’s also the plan for becoming hideously disfigured (it’s actually a pretty similar plan, just with a normal computer), losing my legs in a subway accident, etc.

My point is: prepare for the worst, and have more than one way to generate income. Mostly the last one, actually. It’s probably not healthy to constantly imagine yourself without limbs.

Financial advisors always suggest developing an emergency fund. Some suggest 3 months of living expenses, but I was prompted to write this column when one advisor suggested 8. Most people, when they think about “emergencies,” are thinking about losing their jobs — or, for freelancers, breaking a leg or otherwise having to cut back on gigs.

Eight months just seemed … excessive. What kind of person is going to lose her job and take eight months to figure something out? Well, among others: people with only one marketable skill, people who are completely disoriented outside employment for a large company, and people who put all their eggs in one basket.

So, don’t do that.

We’ve all heard the advice to “diversify your investments,” although most young people don’t have any investments, so “diversify your investments” sounds a bit like “get a high colonic with Dom Pérignon.” But you certainly can diversify your income streams.

Here’s an action plan.

1. If you have a regular job, set a goal to make your salary no more than 75% of your total revenue (yes, revenue — you are a business!) by this time next year. Or, if your salary is really low and your job not that demanding, 50%.

2. If you don’t have any income other than your job, you might start here: How to Make an Extra $100 a Month, Part I and

4. If you have a regular job, consider becoming an intrapreneur. I just heard this word, and, while I try to avoid new corporate coinages (“diversity synthesis = diversynthesis!”), this one is pretty descriptive: an intrapreneur is an employee who starts an enterprise within her company. I am one of these. All the excitement, none of the starvation! I was teaching for a test-prep company, and became an intrapreneur when I volunteered myself to teach a test we didn’t yet teach. At the outset, I was writing worksheets and manuals and slides, teaching pilot classes, and setting up a blog, among many other, sundry tasks. One of the great benefits of being an intrapreneur is that, before too long, other people were brought on board to take many of those tasks off my hands and to do better at them than I could’ve done myself — the lonely company Facebook page has long since been eclipsed by the efforts of a full-time marketing person. Of course, the point here is to make extra money, not just to take on extra work — at my company, I am paid hourly anyway, so I essentially just created as many hours for myself as I was physically able to work, and I was also offered a percentage of revenue for the first year. Your goal in being an intrapreneur is to negotiate something similar. If you can’t get any extra compensation for the extra efforts you are proposing, then use intrapreneurship to gain experience and make contacts, and then create an exit plan to become a real entrepreneur while you’re still young and sprightly.

5. Consider whether you could volunteer at something that would become an income stream within a year. For instance, many programs (such as 826NYC)need volunteer tutors. Once you’ve helped a few dozen kids write papers and conjugate verbs, you can certainly do the same for paying clients as well. Sports coaching, event planning, teaching arts & crafts — there are plenty of areas where the barrier to entry as a volunteer is pretty low, and the jump from being an accomplished volunteer to getting paying clients isn’t all that high either. In areas that don’t require professional certification (teaching knitting), people mostly choose their experts based on personality anyway (you cannot be an asshole while we are laboriously making our own socks).

Of course, it’s still a good idea to have an emergency fund — there certainly are eventualities that are not much helped by the above, such as surviving a bear attack. But an ordinary episode of getting laid off doesn’t have to be an eight-month setback, as long as you prepare now. Setbacks will happen. Jobs have very few obligations to you. No matter how you feel towards your company, companies do not have feelings and thus do not feel loyal towards you; the people within a company who do have positive feelings towards you may themselves not be there later.

So, put 3-6 months’ expenses in the bank as soon as you can. And then diversify your income such that emergencies are close to impossible.

(Check out the Bullish archives for advice on quitting your job, managing your time, and pricing your freelance work).